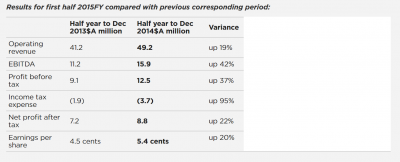

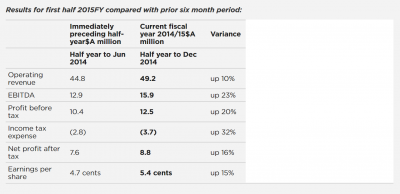

February 26, 2015 – Hansen Technologies Limited (ASX: HSN) is pleased to announce its financial results for the half year ending 31 December 2014:

- Operating revenue of $49.2 million

- EBITDA of $15.9 million

- Net Profit after tax of $8.8 million

- Earnings per share of 5.4 cents, up 20% from the previous corresponding period

The Directors of Hansen have declared a consistent 3 cents per share interim dividend with:

- 2.5 cents per share fully franked

- 0.5 cents per share unfranked

- a record date of 10 March 2015

- payment on 27 March 2015

- the conduit foreign income component of this interim dividend is Nil

- the application price for shares issued in accordance with the Company’s Dividend Reinvestment Plan will be the full undiscounted value

NOTE: Shareholders wishing to participate in the Dividend Reinvestment Plan need to have lodged the required DRP Notice with the Company’s Share Registry by no later than 5.00pm on the business day immediately following the record date. Accordingly the last date for DRP election in respect to this interim dividend is 11 March 2015.

Hansen’s Chief Executive Officer, Andrew Hansen said, “I am pleased to be reporting a strong performance for the first half of this year, with our results ahead of both the previous corresponding period and the prior six month period ending 30 June 2014.

Our results include for the first time a full six month contribution from the Banner business that was acquired in May 2014. This acquisition, coupled with organic growth in our core Billing Systems business, has underpinned the strong increase in both operating revenue and profit over the previous corresponding period. Our increased focus on sales and marketing is gaining further traction with new contract wins in the Utilities and the PayTV industry verticals achieved during the first half.

The decline of the Australian Dollar against the US Dollar has also had a positive impact on our results, though this is somewhat muted at the profit line as a significant portion of our costs are now based offshore.

With the integration of the Banner business successfully completed, this strategic acquisition has added significant capability to our platform in the US, and enhanced our opportunities for growth in the North American utilities market.

We will continue to execute on our strategic acquisition programme, which remains focused on businesses aligned to our core, and transactions that will create additional shareholder value.

In line with the update provided on 17 February 2015, our strong start to the first half of the financial year has been encouraging and we reiterate our guidance for the full year of operating revenue in excess of $95m. We continue to target an EBITDA margin in the range of 25-30% for the full year, and believe we can achieve a result towards the top end of that range if trading conditions remain favourable.”